us japan tax treaty dividend withholding rate

However many treaties still allow you to claim certain benefits even if you become a US citizen or resident. Basically it prevents a citizen or resident of the US from using the provisions of a tax treaty in.

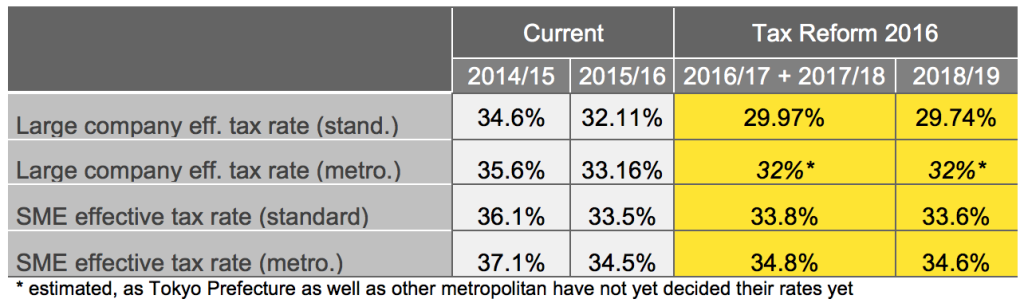

Japan Tax Reform 2016 Japan Industry News

Signed Date Entry Into Force EiF Entry Into Effect EiE Order.

. The tax is thus withheld or deducted from the income due to the recipient. 0 or 275 0 0 or 20. Normally the country of source would grant full or partial tax exemption or impose a reduced dividend withholding tax rate.

In such case no further. From United States tax to interest received by residents of Japan on debt obligations guaranteed or insured or indirectly financed by those Japanese banks or insured by the Government of Japan. Most tax treaties have a clause that preserves the right of each country to tax its own residents so once you become a resident of the US you will lose most of the tax treaty benefits.

US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. A zero rate of tax may apply in certain cases. Now that you know the basics of the United States United Kingdom tax treaty we can get a bit more into specifics that affect US.

However this rate can be reduced to a lower rate or an exemption can be given under the provisions of the Income Tax Act or a bilateral tax treaty between Canada and another country. In most jurisdictions tax withholding applies to employment income. Tax withholding also known as tax retention Pay-as-You-Go Pay-as-You-Earn or a Prélèvement à la source is income tax paid to the government by the payer of the income rather than by the recipient of the income.

A - D E - I J - M N - P Q - S T - Z TECO. A Shareholder who declared that he or she is a resident of a Treaty State and is the beneficial owner of the Dividend may apply to the Agent during the Change of Rate Period only subject to complying with all the documentation requirements detailed below requesting the receipt of the monetary difference between the tax amount remitted to the Agent at a rate of. Since Singapore adopts a one-tier corporate system it does not levy withholding tax on dividend payments.

The treaty has been signed but is not yet in force. If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability to 1300. 0 0 0 Note that a rate of 49 applies in the case of interest and certain dividends where a Tax File Number is not quoted to the payer.

Whether they are taxable in the recipient country would depend on the domestic tax laws of that country and what the treaty specifies. 24 January 1994 EiF. Foreign dividend investors are typically eligible to get a 10 refund according to their avoidance of double taxation treaty.

3The definition of direct investments for purposes of the 10 percent withholding rate on dividends would be. In Japan there is a tax of 10 on dividends from listed stocks 7 for Nation 3 for Region while Jan 1st 2009 - Dec 31 2012 by tax reduction rule. Summary of US tax treaty benefits.

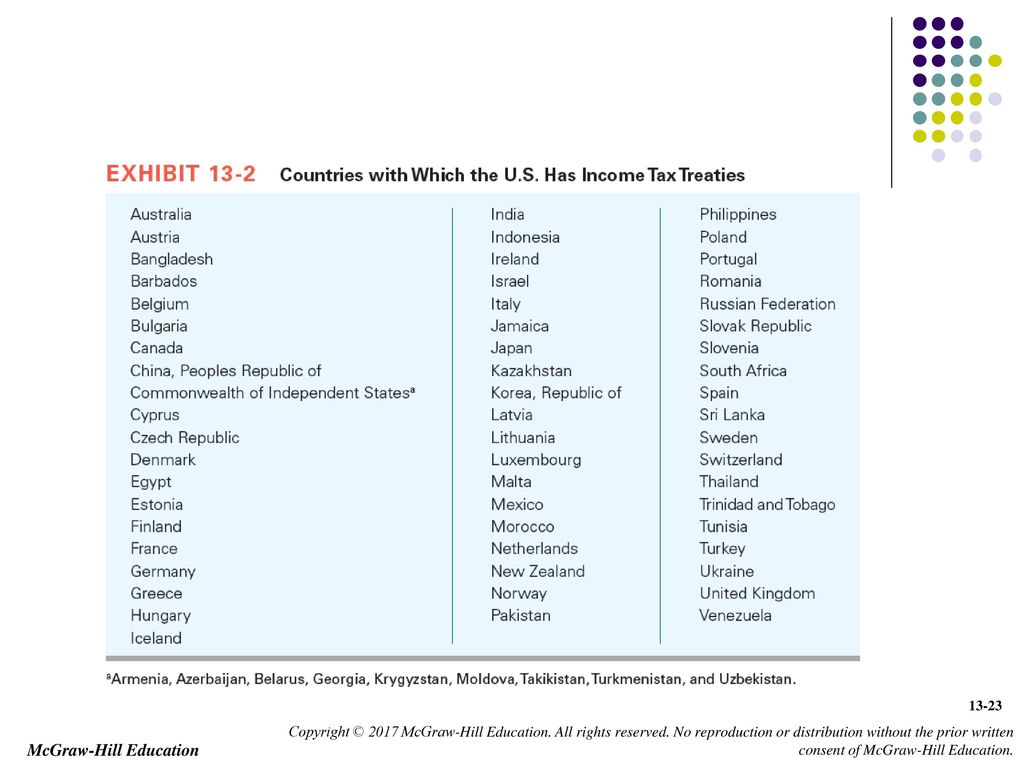

The double tax treaty tells Mark that the UK has the main right to tax the income and that if Germany also wants to tax it then the foreign tax credit method should be used to avoid double tax. It is separate from and in addition to your foreign tax credit for foreign taxes paid or accrued on. The United States is a party to tax treaties designed to prevent double taxation of the same income by the United States and the treaty country.

In the absence of a treaty Canada imposes a maximum WHT rate of 25 on dividends interest and royalties. The lower lowest two for Vietnam rate applies if the beneficial owner of the dividend is a company that ownscontrols a specified interest in the paying. Citizen an additional credit for part of the tax imposed by the treaty partner on US.

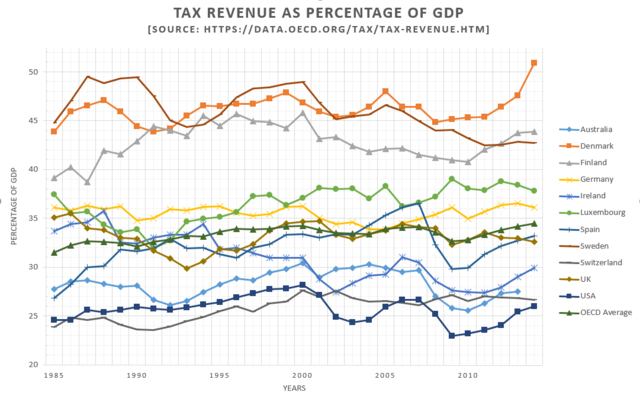

Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. Here is the withholding tax rate for some of the largest countries. These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax.

The current dividend withholding tax rate for Canada is 25. Under Negotiation DTA Withholding Tax Rate Contact Us. Within the tax treaty are specific provisions addressing individual tax concerns.

Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or periodic income may be exempt by reason of a treaty or subject to a reduced rate of tax. 21 August 1995 EiE. 0 or 275 0 or 25 or 275 0.

The branch profits tax shall not be imposed on the portion of the dividend equivalent amount with respect to which a foreign corporation satisfies the requirements of paragraphs 1 and 2 of this section for a country listed below so long as the income tax treaty between the United States and that country as in effect on January 1 1987 remains in effect except to the extent the treaty. Signed Date Entry Into Force EiF Entry Into Effect EiE Order. 1 January 1996 WHT 1.

The most are the Saving Clause and Article 17 US. Certain treaties allow a US. While there are more than a dozen provisions the ones that can affect Americans in the UK.

Several brokers allow you to receive a pre-emptive relieve through the NR301 form and this should allow an automatically applied reduced tax rate of 15. In case of an individual person who has over 5 of total issued. For example if a tax treaty between country A and country B determines that their bilateral withholding tax on dividends is 10 then country A will.

After Jan 1st 2013 the tax of 20 on dividends from listed stocks 15 for Nation 5 for Region. 30 for nonresidents You can view the complete list of withholding tax rates. The qualified dividend tax rate was set to expire December 31 2008.

As the Canadian payer or withholding agent you are responsible for withholding and remitting Part XIII tax at the correct rate. 30 10 30 Note there are certain exemptions that may apply Austria Last reviewed 11 January 2022 Resident. The foreign withholding tax rate on dividends can vary wildly.

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

The U S Taxation Of Multinational Transactions Ppt Download

Dividend Withholding Tax In Colombia For Non Residents

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

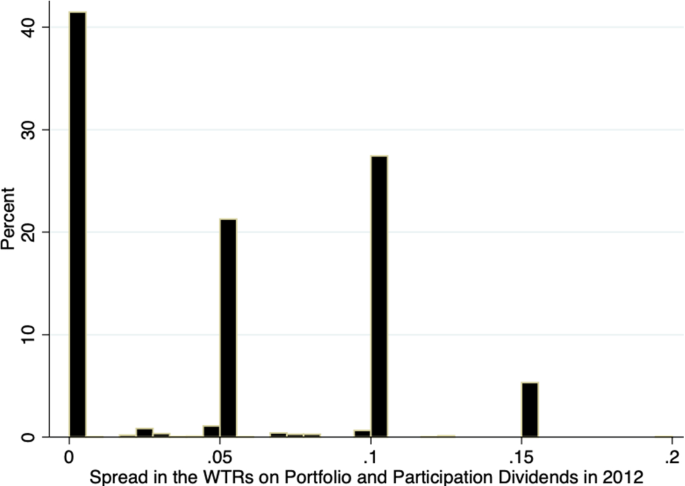

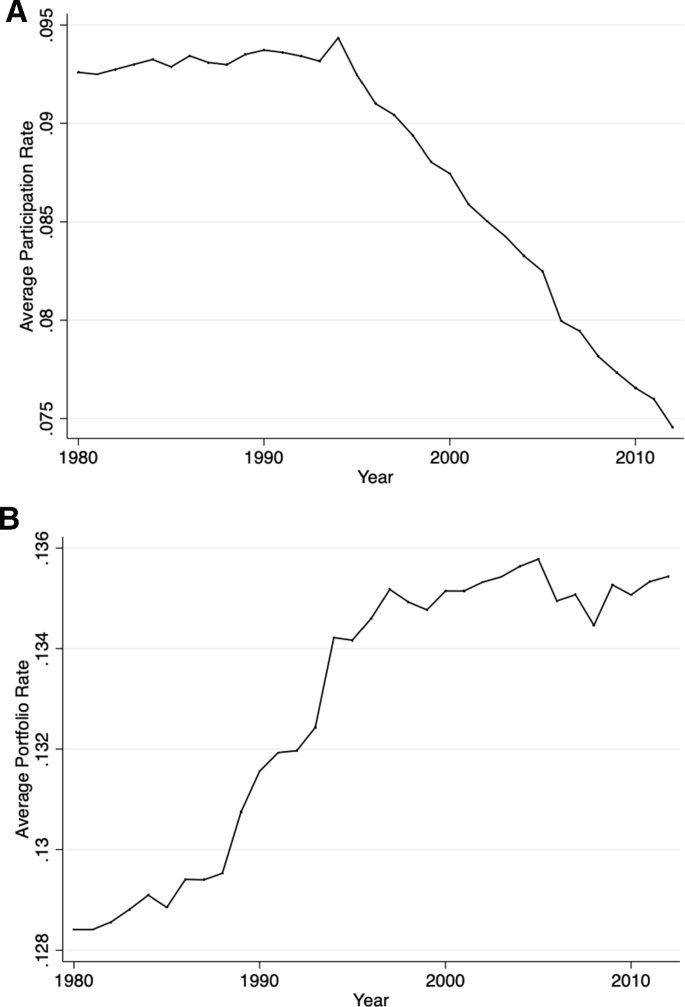

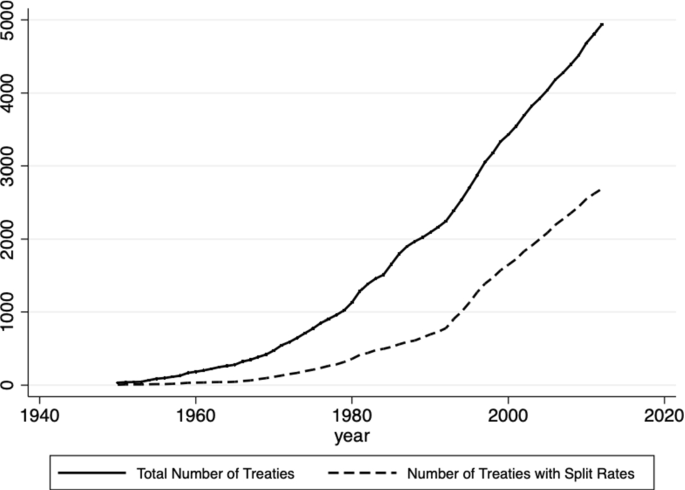

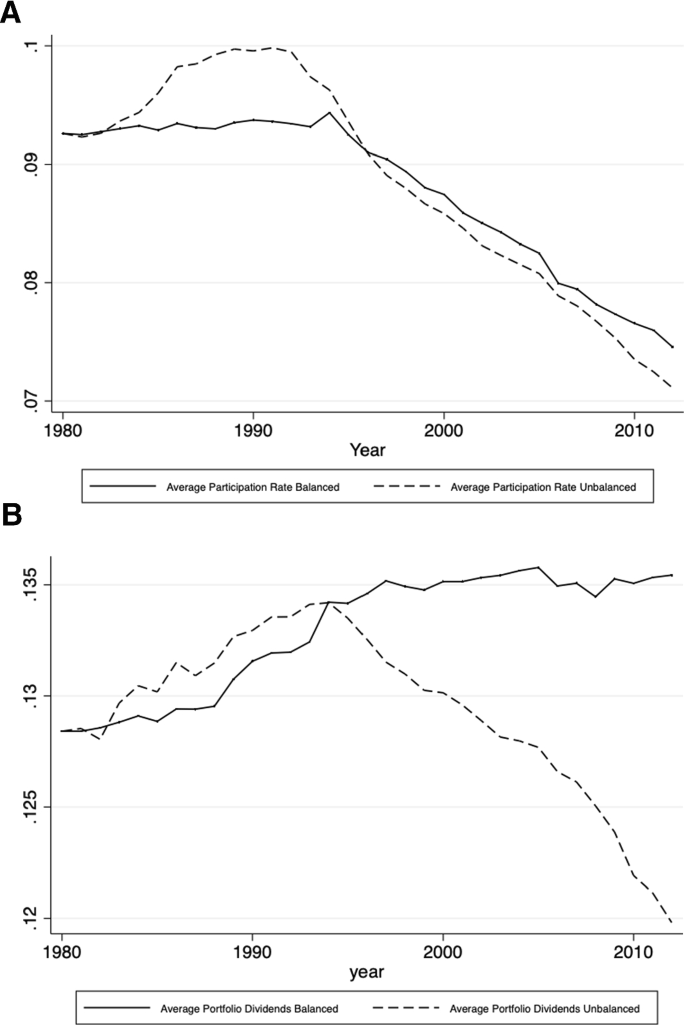

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Japan Tax Reform 2016 Japan Industry News

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog